Buy Now, Pay Later for In-Store Transactions

In today’s fiercely competitive retail landscape, staying ahead requires adapting to consumer trends. One area of retail that has overgone a large set on innovative in the past decade is payment methods. From the rise of digital wallets, we are now seeing a new financing option that has taken storm. Out has gone layaway in comes Buy Now, Pay Later (BNPL). This blog post explores the impact of BNPL on brick-and-mortar retailers and delves into the intricacies of how it works, while providing real-life examples of its successful implementation.

What is Buy Now, Pay Later?

Buy now, pay later is a payment model that allows customers to make purchases and split the payment into interest-free installments over time. Unlike traditional credit cards, BNPL services offer customers a convenient and flexible way to manage their finances, without the burden of accumulating interest charges or long-term debt.

Why have customers become drawn towards it?

Customers are increasingly drawn to BNPL for several compelling reasons. Firstly, attitudes towards credit cards have been shifting when compared to BNPL, with many individuals seeking to avoid potential debt and interest charges. According to a PYMNTS survey, 60% of consumer stated that they prefer to use BNPL instead of a credit card.

Secondly, BNPL services typically provide longer payback periods compared to credit cards. This extended timeline allows customers to spread out their payments, making it easier to manage their budgets and financial commitments effectively.

Lastly, BNPL options are more accessible, especially for younger generations who may not have established credit histories or prefer to avoid traditional credit options. The rise of digital payment solutions and the convenience they offer align perfectly with the preferences of tech-savvy consumers.

Overall for retailers it offers another payment option which is gaining popularity which customers prefer to purchase with the market projected to double by 2027 reaching 900 million users.

How does it work for brick-and-mortar retailers?

While BNPL systems initially gained popularity in e-commerce, their integration into brick-and-mortar stores has opened up new opportunities for enhancing the customer experience. Retailers can partner with BNPL providers to seamlessly integrate their services into the in-store payment process. Let’s explore the different methods through which BNPL works in brick-and-mortar environments:

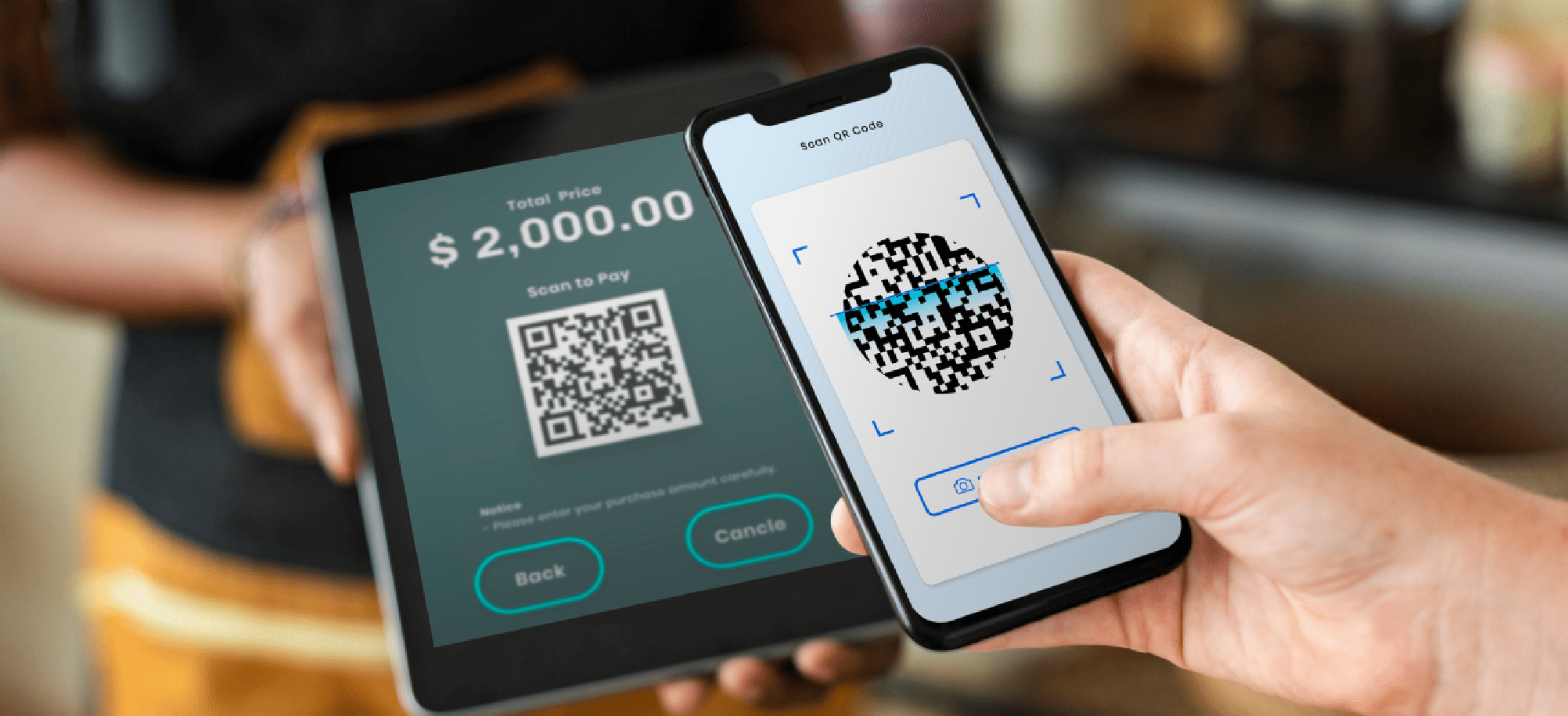

Integration with Payment Providers via QR Code

Retailers can collaborate with BNPL providers that offer QR code functionality. At the point of sale, customers can scan a unique QR code displayed by the retailer. This initiates the BNPL payment process, seamlessly connecting the customer’s purchase to their BNPL account. Klarna, a leading BNPL provider, offers a QR code feature that allows customers to make in-store purchases by scanning the code at the register through Verifone payment terminals. This streamlined process reduces friction during checkout and provides a convenient payment option for customers.

Integration with the Point-of-Sale (POS) System

BNPL services can integrate directly with the retailer’s POS system, creating a seamless and integrated payment experience. Customers can select the BNPL option at the checkout, and the transaction details are processed in real-time. Retailers can collaborate with BNPL providers like Affirm to integrate their services into the existing POS system. This enables customers to split their purchase into interest-free installments directly at the checkout counter, by enabling the system to send a link via text or email to complete the purchase.

BNPL Cards Through the Provider’s App

Some BNPL providers offer their own mobile apps, allowing customers to generate virtual cards for in-store purchases. Customers can use these virtual cards just like regular debit or credit cards, with the purchase amount later divided into installments. Affirm, a prominent BNPL provider, introduced a virtual card feature within their app. Customers can shop at participating retailers and choose the Affirm payment option, generating a unique virtual card for the transaction.

Unlocking Opportunities and Enhancing the Shopping Experience

By incorporating BNPL options into their operations, brick and mortar retailers can attract a broader customer base, cater to changing preferences, and drive sales. The convenience and flexibility of BNPL contribute to an enhanced shopping experience, fostering customer loyalty and satisfaction. Retailers now have varying options to integrate these systems as well whether it is through a custom integration with their payment or POS system or through just signing up to become an authorized retailer which customers can purchase through the providers app. By embracing this innovative payment model, retailers can stay ahead of the competition, drive sales, and nurture lasting customer relationships in the dynamic world of retail.